Market research is invaluable when you are thinking about buying or selling a practice. Specialist business property adviser Christie & Co has produced a document called The Dental Industry 2018: Staffing, Brexit and The Dentist Shortage. We thought there was an oversupply of clinicians (see our 2014 book Moonwalking For Dentists), so our interest was piqued and we called Simon Hughes, Managing Director — Medical at Christie & Co for a chat.

Simon, did anything surprise you in the report?

It’s counterintuitive that the number of EEA qualified dentists working in the UK was falling prior to the referendum and has been flat since, despite a reduction in new registrations from the EEA. We think that the some of it had been factored in pre-referendum and this has certainly been the experience in other sectors, such as hospitality.

It says the dental market is “highly fragmented”?

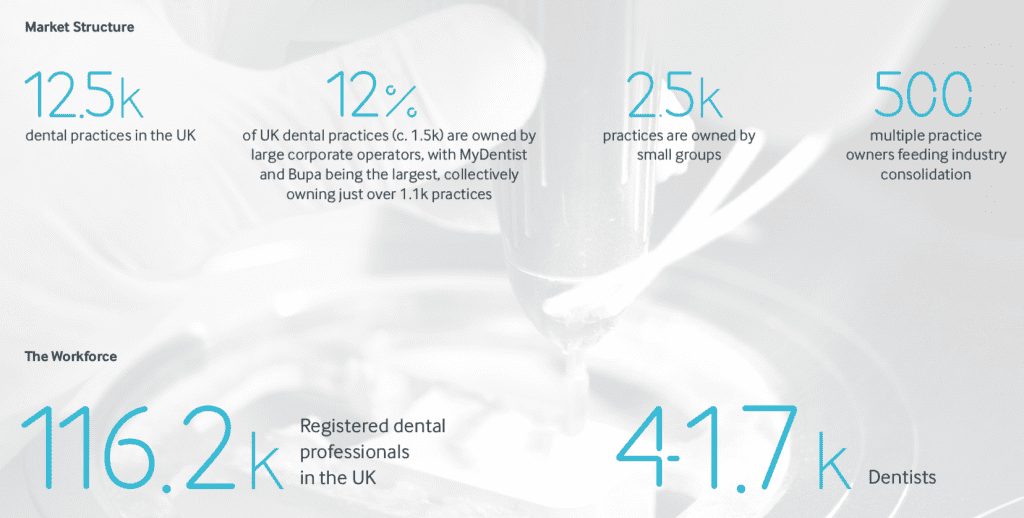

It is, by which we mean that there is a large number of independent owners in the dental sector compared to corporates. We estimate that only about 12% of the market is ‘consolidated,’ which compared to other sectors such as the pharmacy and veterinary sectors, is very low. This is driving corporate activity in dentistry.

What is the evidence that there is an undersupply of clinicians?

Our report reflects the market, which shows that associates want to join the private sector earlier in their careers, and there are well documented recruitment and retention issues. Meanwhile there is a blockage at the other end. In terms of the performance of NHS contracts, it’s not a single factor — there has been a backlog of six or 12 months in new performers receiving their numbers so young dentists who are ready to work can’t get onto the NHS list. That’s impacted the performance of some NHS contracts.

Another related factor is increasing risk aversion among younger dentists. Two years ago, the average NHS associate did 7.5k or 8k UDAs per annum, but that’s nearer 6k or 6.5k today. Principals have to do more themselves or recruit to make up the difference, which is getting harder.

Why then is NHS dentistry still so attractive?

It’s the so called evergreen nature of contracts that banks and buyers love. Even with the turmoil in NHS orthodontic reform, this is a powerful incentive. Similarly in the pharmacy sector, you’re buying the right to receive government income in perpetuity and no one can open an NHS practice next door to you. So about 80 per cent of the calls we get are from dentists wanting to buy NHS.

The report says “any government efforts to improve the supply of dentists require careful consideration to ensure dentists support the NHS”?

When contracts were last changed, many dentists simply handed their contracts back and went private, so from 2006 to 2009 there was a chronic lack of NHS dentists. One of the reasons the reforms are taking so long this time around is that they don’t want that to happen again. It will be interesting to see if it does.

The report calls for better training for therapists and hygienists. But with direct access isn’t this one on practice owners?

There is a shortage of therapists. However, dentists are not always great at change. If you’re an associate and you have been earning well in the UDA system, and then your principal gives a therapist 2k of your UDAS and asks you to grow your private list, it might not go down well. So dentists further on in their careers are perhaps more resistant to change. Juxtapose them with the younger, less qualified associates who are pushing hard to do more private work.

Isn’t it better for dentists to be in undersupply?

If you’re a principal, possibly not. It pushes pay up so you might need to include golden hellos to compete with the corporates. In the past three years, pay per UDA has gone up in London and the Home Counties — areas with more practices — which is a direct result of a shortage of good dentists. Yet there has been no increase in NHS funding, so that extra pay comes off your margin. We’ve seen margins reduce from a high of 23 or 24 per cent down to 21.5 per cent.

Where is good place to set up according to your data?

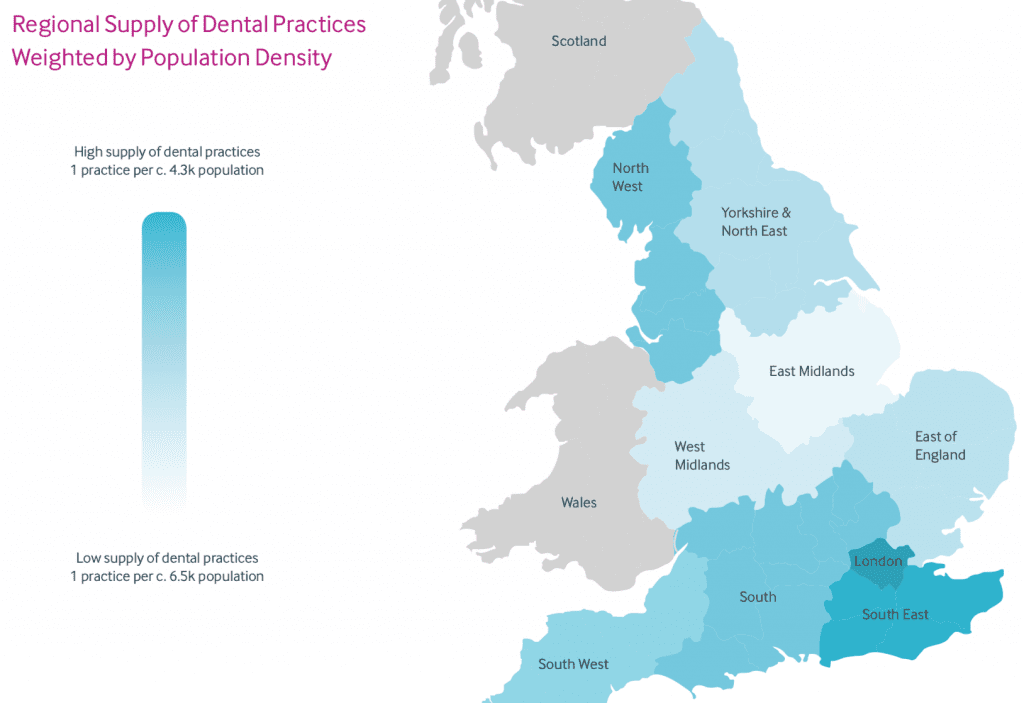

The West Midlands has a low supply of dental practices and the lowest associate pay rates per UDA [see pages 21 and 22 of the report], which might look like an opportunity to some buyers.

Do associates really care about pay rates per UDA, wouldn’t they rather just work privately?

It depends, generally newly qualified dentists will work in the NHS for a few years, then look to move into the private sector and possibly a specialisation afterwards. Many dentists feel very strongly about the NHS and are very happy working in that system.

Does your section on EBITDA in the 2018 market report factor in the principal’s time and adjust profit accordingly? 21.5 per cent seems high.

Profit margins vary greatly, depending on a number of factors, so the 21.5% is simply an average across the board. We have seen very good businesses making less profit and some not so good ones making more!

However, pricing is something of a dark art, so if you’re buying a practice, it’s vital to really understand what the actual profit is that the practice is making not just believe everything you read!

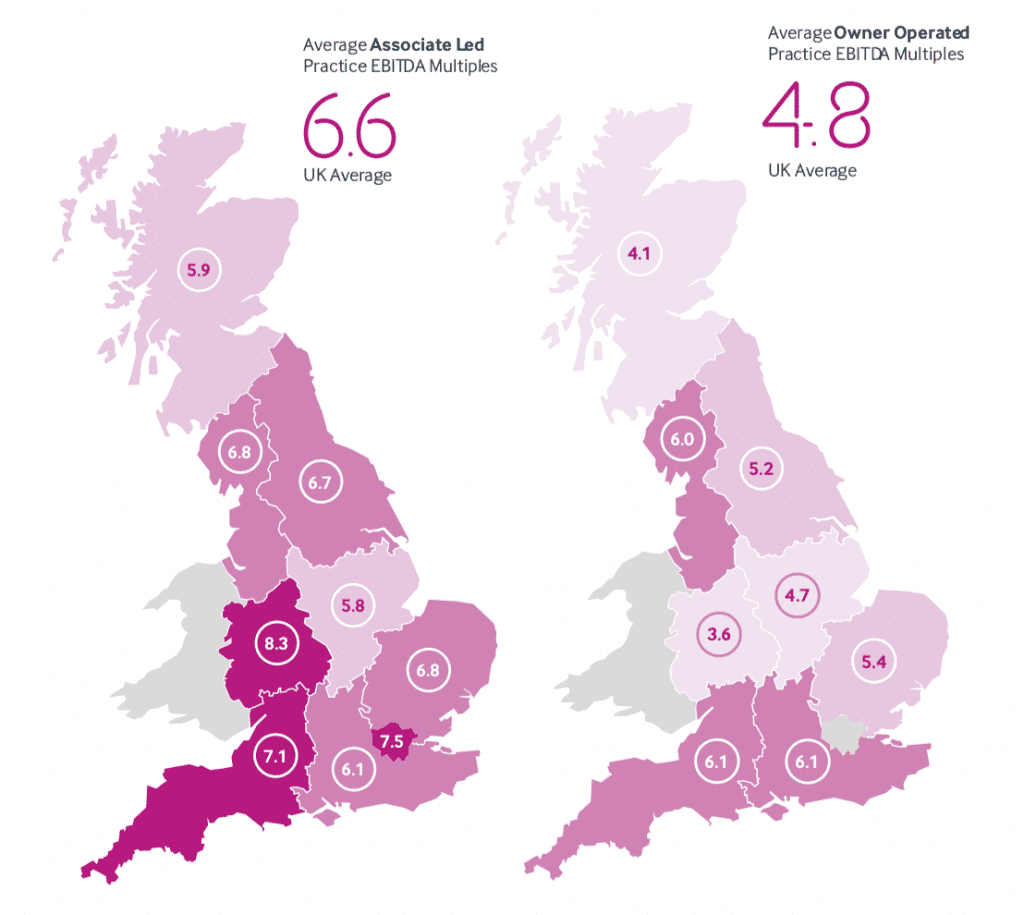

Ultimately every practice that changes hands is valued by a qualified independent valuer though, so it all comes out in the wash. We are the only broker that also does formal valuations for the banks. The work is regulated by the Royal Institution of Chartered Surveyors and our methodology is driven by the lenders — bear in mind most transactions in dentistry have banks behind them. On pages 10 and 11 of the market report we map out average EBITDA multiples by region according to two models: owner operated and associate led.

How do you define an associate led practice?

These are larger practices with turnover of £700k or more (typically) that are “under management”. The grey area is where you have a principal working in one that is big enough to be associate led — there you have to factor in income the principal is generating. Usually owner operators contribute more to the profit, so the EBITDA is lower and the multiple is lower. There is clear evidence that groups sell for a premium multiple compared to single assets.

Do you expect the EBITDA multiple to swing in private practices’ favour soon?

Do you expect the EBITDA multiple to swing in private practices’ favour soon?

This process is already happening. Multiples for fully private practices have increased in the last 12 months at a greater rate than other types. Meanwhile NHS margins are down because of increased associate costs.