Christie & Co published its 2019 Dental Market Review this week, a succinct and easy to digest document that’s worth a look if you’re buying or selling a dental practice in the UK. We caught up with Simon Hughes, Managing Director — Medical at Christie & Co to discuss some of the trends it’s identified.

Simon, the report says finance is abundant because dentistry is still seen as low risk. Is there a danger that underprepared first time buyers are waved through?

Banks are stress testing their own balance sheets and the due diligence they do is more intense than before. While buyers often focus on the interest rate and loan to value, the most important issue for banks is serviceability. Dentistry is not without its business casualties, but they are tiny compared with other sectors like social care and hospitality. Provided the borrower is not living a lifestyle that’s out of kilter with their profits, generally the risk of going bust is very low.

The parlous state of NHS dentistry seems to be fuelling the private sector — is this going to change?

No. You only get limited treatment on the NHS, and one could argue that it’s moving to a place where it’s more like an emergency service. Yet despite the horror stories about access to NHS dentistry, if you look at popular culture, everyone in the public eye has good teeth now. This is a general comment about dentistry: we feel the profile of dentistry is a lot higher than it ever has been and because of the limited treatments available on the NHS people are going to continue to spend their disposable income on private treatment, whether that’s essential dental maintenance or the cosmetic and aesthetic options that have exploded in recent years.

The report says there are 3,000 registered applicants looking to buy in the UK. Are these registered with you?

Yes. We have several thousand applicants registered but of course not all are active. The 3,000 quoted have actually shown some activity but the general point is that demand outstrips supply by a significant margin.

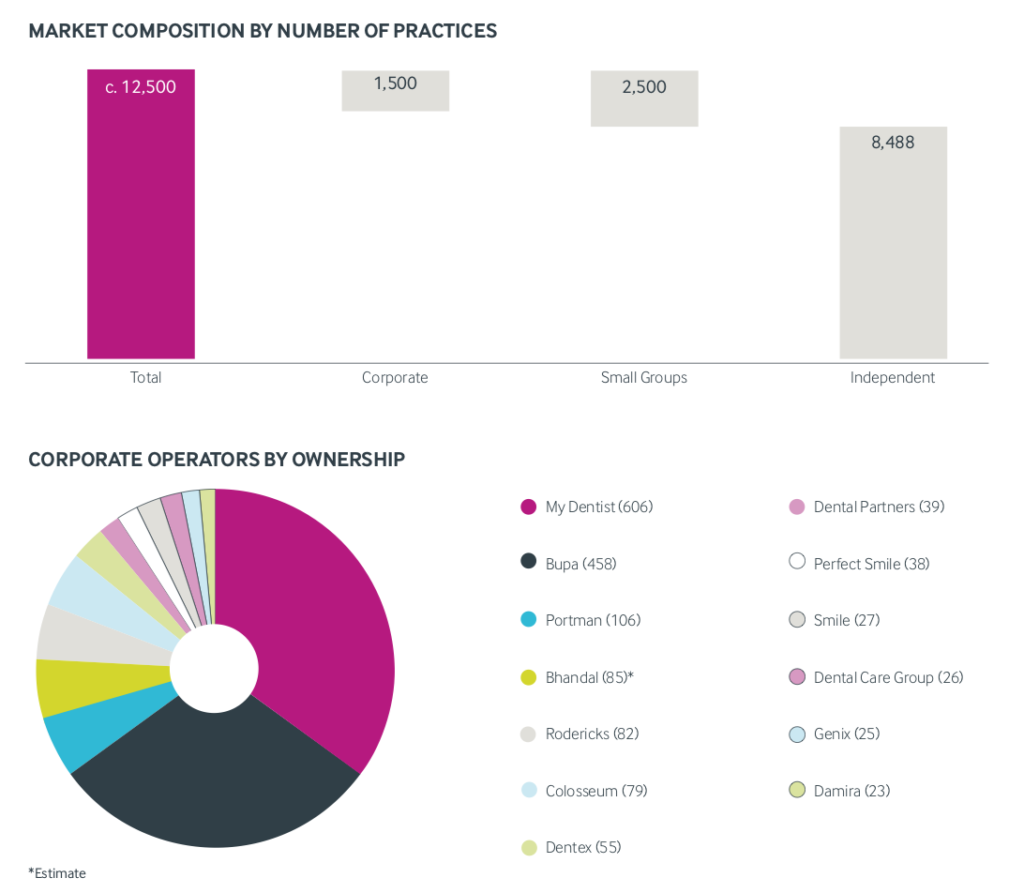

A ‘mid-market’ is emerging as players such as Dentex, Dental Partners and Perfect Smile move towards or through the 50 site mark. What’s going to happen over the next 10 years?

The market is getting sucked uphill. If you look at how much cash dental businesses inject, together with the amount of family money and investment from banks supporting the sector, it all enables small groups to become mid-size groups pretty quickly. I met someone yesterday who has 12 practices. They had two just over a year ago.

Graphs from Christie & Co’s Dental Market Review 2019

Provided the economy remains as it has been, I would expect significantly more new groups with between 10 and 25 practices to emerge over the next few years, looking forward five years there could easily be 25 of them. And if we have seven groups with more than 50 practices today, that could be 12 or 15 in the future. At the top of the sector, most corporates have been sold to private equity. Bupa is ‘not for profit’ and the Bhandals a large family business.

Those big ticket deals have therefore been done with private equity, so what does private equity do next? It either sits and waits or it fishes lower down the value chain, and that’s what we saw this year when Apposite Capital invested in Alpha Vitality Group, a 10-practice dental group operating in the North East — private equity activity where we have never seen it before.

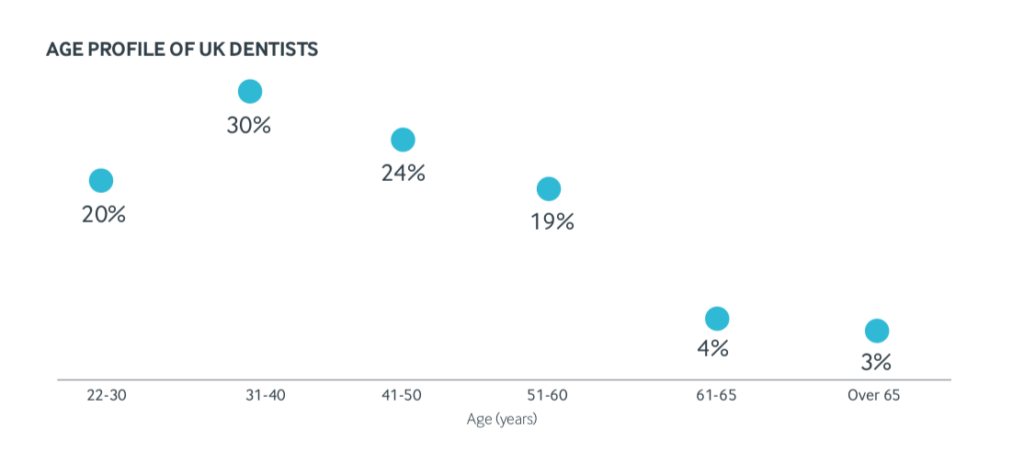

The most populous age bracket of dentists in the UK is 31 to 40, comprising 30% of the workforce. What do you make of this?

We are seeing changes in the workforce dynamic and the age is interesting. Even more interesting is the ratio of female to male practice owners and how that’s going to be changing. As our 2018 report on staffing, Brexit and the dentist shortage showed, 63% of new undergraduates in 2017 were female. So there will be many more female practice owners in the future who will then be having career breaks to have children, and that will have an impact on dentistry going forward — we’re only at the beginning of that shift [currently 49% of dentists are female].

Graph from Christie & Co’s Dental Market Review 2019

Also there is a shortfall of therapists, and most therapists are female [as are 92% of non-dentist dental care professionals]. This shortage, and the resistance among some dentists to therapists taking associates’ work, has to change. The changing skills mix is something that the corporates are looking at closely. They see it as a way of mitigating the recruitment crisis. There’s a rush on trying to find the right people because if you haven’t got the therapists coming into your group you can’t execute the business plan.

We talk a lot about costs increasing in dentistry, which they are — nothing is going down — but a better use of the skills mix could have an overall benefit on delivering dentistry at an associate level. Practices that get it right could make some significant savings [see this case study on the disruptive therapist business model]. Looking forward I would expect the landscape, personnel-wise, to look different in five years.

The report says a two-tier market is emerging in the NHS sector. Does that mean buyers should be extra careful when buying an NHS or mixed practice?

The average price rise was 5.2% last year. Under the surface you’ve got two extremes: the first is underperforming rural practices where recruitment is considered difficult. The price of these practices has fallen. Then you have larger urban and semi-urban practices, where contracts are being performed well, and here the values have continued to rise.

The reduction in prices is a result of buyers and their banks valuing businesses on actual contract performance rather than baseline contract value. You might have an NHS contract that’s worth £500k but it is performed at £450k because you can’t get the staff — that practice will now be valued based on the turnover of £450,000, not the baseline contract of £500,000. So the market has adjusted.

So buyers should be asking what is the level of actual income rather than what is the contract worth. Yes, you still have your patient list, but the challenge is getting the dentists in to perform those UDAs. There is a greater level of due diligence happening during purchases, which is in the best long term interests of the sector. The last thing anyone wants to see is practices failing. There is not that unconditional “buy it at any price, anywhere” mood that there was perhaps three years ago.

The report says there is a discernible shift in demand towards the private sector. Is private a more predictable investment?

All these issues are interrelated and come down to recruitment and retention. We did a seminar a couple of weeks ago with a group of multiple operators. Some were NHS, some private. They had vastly different experiences of recruitment and retention — it’s much harder in the NHS.

We’re seeing dentists shift to private work and specialisms much earlier in their careers. How can you keep your talented associate if you can’t offer them career progression? It’s one and the same thing: if you retain your associates by giving them career progression into private work, then you are going to be developing your business.

A lot of groups still see NHS as invaluable in terms of getting patients through the door, but rising costs mean they are having to find new revenue streams. There’s a lot of focus on the organic growth of private lists, and also a focus on the acquisition of fully private practices to balance out the ratio of private revenue against NHS revenue. For example, if you have a portfolio of 20 practices and 90% of your income is NHS, you’re in a good place in terms of guaranteed income, but to mitigate the challenges of recruitment you’ve got to build your private income stream.

Alternative partnership structures with vendors are being explored by groups, is this a significant shift?

We’re not sure yet whether it’s a coincidence or a trend, but in the past six months we’ve had more conversations with owners, start-ups and potential owners who are using equity or profit shares in their business as means of attracting and retaining associates. I think it’s too soon to tell whether there’s something changing here, although it’s very interesting.

If you own a portfolio and you know that finding and retaining quality associates is one of your key challenges, what are the means available to you? You can pay them more, which reduces your margin and is a blunt instrument, or you can be more creative and offer equity, which could be a win win.

If you need a dental coach to guide you through your acquisition in the UK or Ireland, or you need ongoing dental consultancy support to grow your group rapidly, Fine Company can help.