How is life in the trenches going? If you’re still alive I suppose that means quite well, all things considered. Having previously set out what to do to get your dental practice through lockdown, I’ve been modelling how cashflow might look for a typical practice a year into the brave new world, given what we know of extra PPE costs, current guidelines on who you can treat (emergencies only), and what you can change to maximise your trading position, like opening hours.

I have to say it looks pretty scary, but before I get into the numbers let’s take a moment to acknowledge the wider context. You can be grateful that you are not the owner of a pub or restaurant. If you were you’d be much further along into an existential crisis. Yes you are facing the risk of an unprecedented and ongoing collapse in revenue but nevertheless the service that your business provides is essential. Eating and drinking out, and many other activities, are not. Compared to dentistry, many other sectors are seeing comparable or worse collapses in revenue, and anyway we may be heading for a collective financial maelstrom the likes of which we have never seen. In the years ahead we may look back fondly on these months as a calm before the storm.

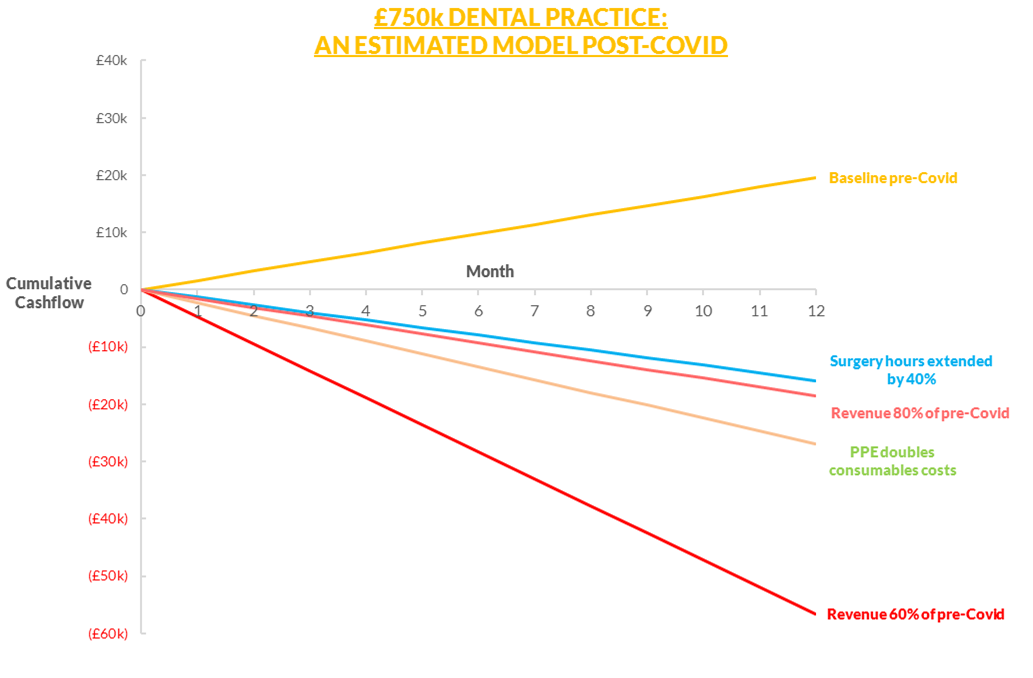

Now to the practicalities. What to do. The idea that once you reopen your business it will spring back to life as a magic money making machine is mistaken. I’m showing you these graphs to demonstrate that reopening without a deep understanding of the economics can get you into serious trouble quickly. That’s not to say you can’t build a survival or growth strategy that factors the deficit in, only that we should be going into any reopening phase fully aware of the projections. So here are two models.

1. How 4 factors affect cashflow

Here, using typical numbers for a practice with £750k revenue (including a fair £10k a month pay for the principal and all the usual costs including loan repayments), I’m showing what happens to pre-Covid cash when you

- increase opening hours by 40%;

- see a 20% drop in pre-Covid revenue;

- double your consumables costs thanks to new PPE requirements;

- see a 40% drop in pre-Covid revenue.

Note this is what happens to cashflow when each individual factor plays out in isolation. In reality we expect to see some combination of these factors play out, so these factors should really be stacked, which would make for a much steeper decline into negative cashflow.

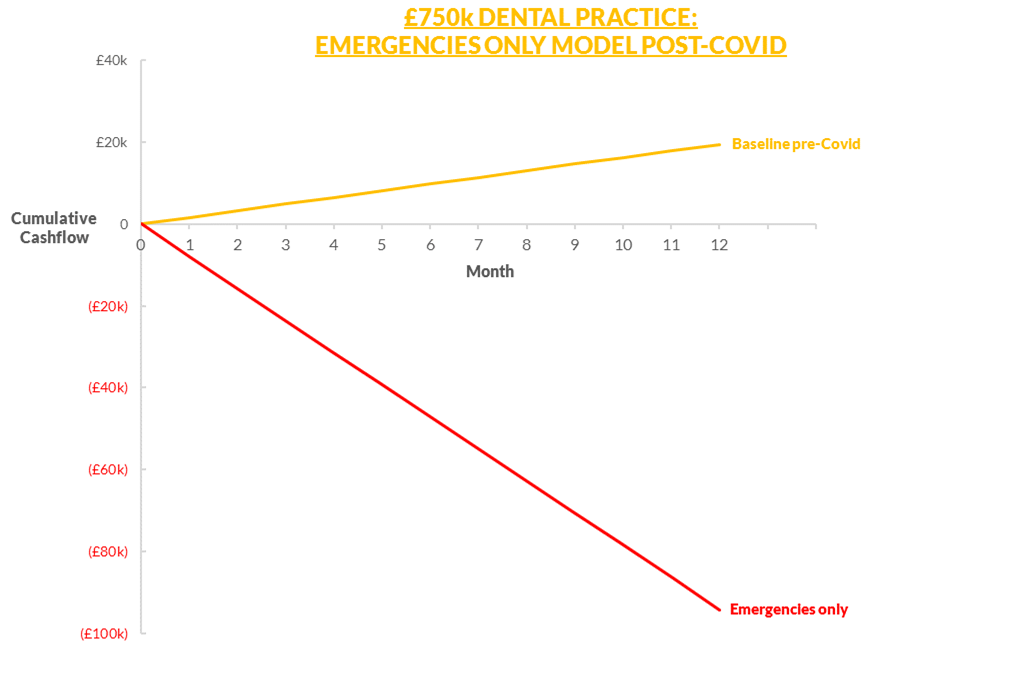

2. Emergencies only

Currently this seems to be where we are as a sector (as at today 22nd May). There was the CQC farce about issuing “you must shut” guidelines then quietly backtracking, pointing practice owners instead towards their indemnity providers for clarification. So the issue is far from clear and may change at any time, but this is where we currently are. I’ve pegged fees from emergency dentistry at 20% of pre-Covid levels. For argument’s sake I’m assuming you will pay yourself a market rate like an associate and that your wage bill will be 40% of turnover (because I’m factoring in substantial natural wastage into the system). At these levels, other things being equal, you make a £100k loss by this time next year.

Currently this seems to be where we are as a sector (as at today 22nd May). There was the CQC farce about issuing “you must shut” guidelines then quietly backtracking, pointing practice owners instead towards their indemnity providers for clarification. So the issue is far from clear and may change at any time, but this is where we currently are. I’ve pegged fees from emergency dentistry at 20% of pre-Covid levels. For argument’s sake I’m assuming you will pay yourself a market rate like an associate and that your wage bill will be 40% of turnover (because I’m factoring in substantial natural wastage into the system). At these levels, other things being equal, you make a £100k loss by this time next year.

Obviously we could take the principal’s pay out, and you could continue to defer loan repayments, which would get you closer to breaking even, which begs the question: would you be prepared to run your business like a charity for one year in order to survive? Consider that the corporates usually won’t have that luxury because all their clinicians need to be paid. So who can outlast who? You might also consider rival independent practices in your catchment area. If they stay shut and you reopen, can you steal a competitive advantage that widens into the future?

If you are allowed to reopen and do a small range of treatments you’ll be able to learn things that competitors that stay shut won’t learn. You’ll iron out kinks in your adapted business model, learn how to communicate with patients in new ways, and consolidate. If your advantage gets entrenched through the public perception of your business as successful, the confidence of your team and your new commercial edge, you could come out of the bloodbath much stronger, relatively speaking. Market forces can do the dirty work for you, you just need to survive.

Perhaps this £100k deficit could be viewed as an “investment” phase. To go back to the corporates, they may see a 15% group wide profit margin. They still have their obligations on capital repayments and central costs like the management team’s salary to meet, and 15% of a revenue that’s down by 80% won’t meet these costs. So while some think that the ensuing 12 months will see corporates hoover up independents at bargain basement prices, it’s equally true that the corporates may come unstuck too, opening up unprecedented opportunities for aggressive independents.

If you’d like to explore how your practice cashflow might look 12 months after reopening, with a bespoke version of these forecasts, get in touch.