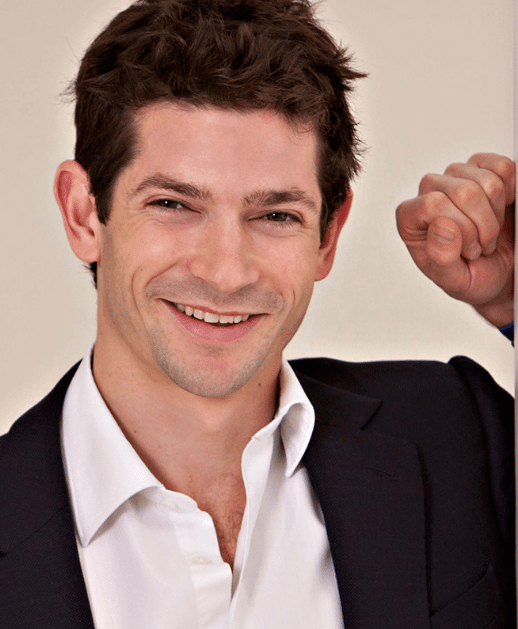

After mistaken reports of a £300m buyout by Southern Dental, Portman Dental Care has refinanced, with Core Equity Holdings acquiring Livingbridge’s stake. I caught up with CEO Sam Waley-Cohen, who has his shoulder at the wheel again after a short break.

Sam, how are you feeling?

I’m enjoying myself, working hard. From our side the headline terms are a distraction. It’s really about the future as much as anything else and that is super exciting. I’m really pleased to have found a long term investor who is going to support us to keep going.

Where does Portman go from here?

We continue what we’ve been doing. What was interesting is that Core did a load of due diligence, thousands of surveys, and confirmed just how differentiated Portman is and how well received it is by stakeholders. From a patient perspective our net promoter score was three times the market average. Patients stay longer with our practices and are less likely to leave. Our clinicians rate us first in the market across all metrics, whether it be the quality of equipment, clinical freedom or ability to attract patients. Many of our practices are new acquisitions [Portman grew from 27 to 75 practices since 2014], so we’re seeing our strategy of choosing high quality partners paying off in these figures.

Did Core Equity give you targets?

There are no imposed targets from Core, they love what we’ve done and want us to continue. I’m continuing as CEO and there has been no personnel change.

So why change partner?

Livingbridge had brought as much as it could to the table. This was a chance to work with experienced people who have taken businesses into the next stage. The Core team all come out of consultancy backgrounds and their challenge is to help us continue to be differentiated and keep our values as we get bigger. They’re in for a decade and it could be up to 17 years, so they are a long term value investor. As you get bigger you can hire ever more talent and people with experience, but the challenge is how do you make sure the whole organisation shares the same set of priorities and culture? As I heard someone put it, how do you get the tomato sauce into the pasta? Keeping the same flavour is the challenge when you’re spread out, and they can help us achieve that.

What’s happening for you personally?

I’m working hard. It’s the nature of the beast, it’s fun and I’m enjoying it. I’m happy to carry on and commit to the sector and this business because there’s space for a company to really set the tone for how private dentistry is delivered. We say grandiosely that we want to be the best group in the world. It’s not about scale, it’s how well can you look after patients and clinicians as you grow. Our next phase is about bringing the benefits of scale to continue to deliver these things.

What’s changed for clinicians in the Portman family?

The infrastructure is getting bigger, the marketing team is growing, there are more resources and our capability to deliver projects is better. We’re starting to think more about labs and digital workflow. Core is keen to support that, but it’s not easy to deliver. The good news is we can now take a bigger and longer term view in terms of getting that to work.

What’s special about this deal in the context of the dental sector?

Essentially we have just changed our sponsor and remain very large shareholders. That’s important because there’s so much noise about private equity with short term time horizons and this is absolutely the opposite. It’s deep investment, value investment, delivering something sustainable into the future. It’s cutting against that narrative and it’s a great vote of confidence in dentistry UK to have an international investor like this despite all the noise around NHS reform.